Low inventory and rising prices continued into March, as reflected by the latest figures released by the Honolulu Board of Realtors this week. But the pace of sales has slowed ever so slightly, offering buyers some breathing room to find the home of their dream.

Buyers may also be further encouraged to find there was an inventory boost — an 11 percent increase in active listings in the condominium segment in March, adding some much needed inventory to choose from.

Of course, as we near summertime, any respite may not last long. Confident sellers, looking to cash in on their equity, will move to price their properties for the summertime fever. Kalama Kim, Principal Broker at Coldwell Banker Pacific Properties, cautions sellers about how overpriced homes may turn buyers away.

“Sellers have been very optimistic with pricing their homes this year, as they have watched prices continue to rise, and buyers battle for homes. So, it is understandable they may want to price their home at the top of the value range,” says Kim.

“But even though homes are selling quickly in today’s market, sellers should resist the urge to price too high. Buyers will stay away from illogically-priced homes and often won’t even submit a low offer with the fear of being utterly rejected.”

There’s no substitute for a talk with an experienced Coldwell Banker Pacific Properties real estate agent about what price point is realistic for your home and your neighborhood. Realtors® are experts on how you can get top dollar for your home, including what improvements might best increase the marketability — and the sales price — of your home.

“If a seller has the means to invest money into preparing their home for sale prior to listing it on the market, they can maximize the selling price of their home,” says Kim. “The priority list of improvements should be based on increasing the pool of buyers who will be attracted to the home. It should start with items that may make a difference on whether or not a lender will finance the property. Next, put yourself in the shoes of a buyer and identify the items someone might consider deal breakers, which may include worn carpets, damaged flooring, or stained walls.”

Don’t forget the home’s exterior. Even though we are advised to never judge a book by its cover, buyers often make up their minds about a house within 30 seconds of pulling up to the home.

“Curb appeal is one of the first impressions the buyer has of a property. Even the simplest detail like failing to remove trash cans from the front yard or pulling the weeds can skew the buyer’s perception of the property.”

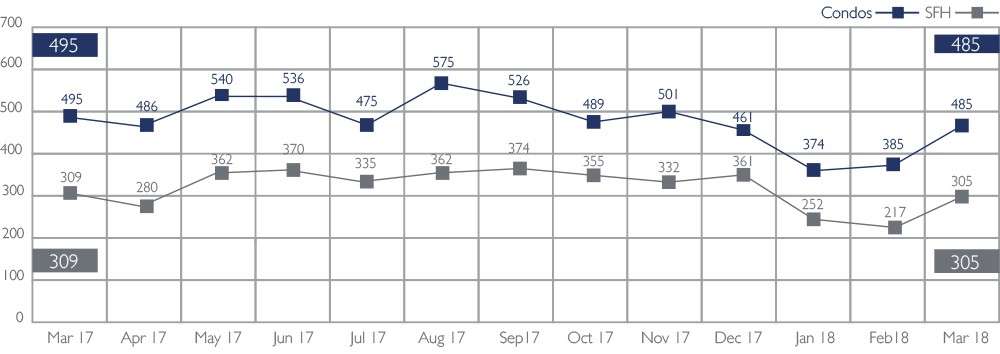

Sales of Single-Family Homes and Condos | March 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

Sales volume, which tracks the pace of sales, slowed ever so slightly on Oahu — down 1.3% from 309 single-family homes closed in March 2017 to 305 closings last month. Condo sales volume was down 2%, from 495 in March 2017 to 485 last month.

Pending sales are also down — 12.3% and 11.1% respectively in the SFH and condo segment. While these dips may not faze sellers with summer fast approaching, buyers may see a slight respite, enough to motivate them to step up their efforts.

First Quarter 2018 sales volume statistics ran neck-and-neck with the first quarter 2017. In the first three months of 2017, 777 single-family homes closed, compared to 774 for the same period this year — down 0.4%. The number of condo closings during the first quarter 2017 was 1,235, compared to 1,244 this year — up 0.7%.

Perhaps most telling, the number of days on the market dropped significantly in both categories — to 14 days for SF homes, and to 16 days for a condo.

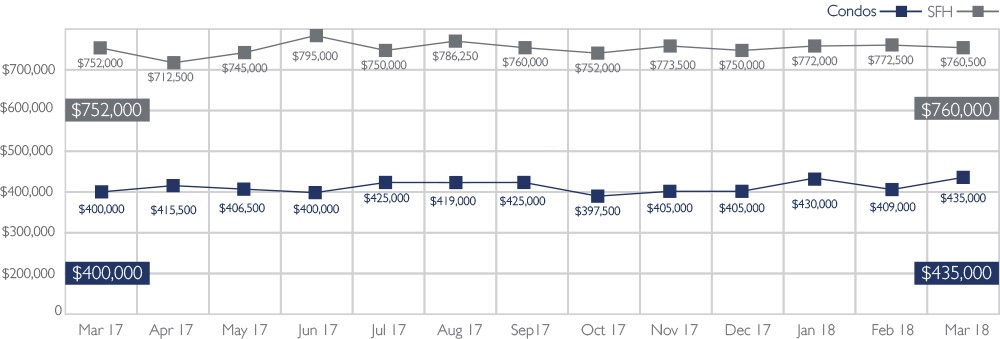

Median Sales Price of Single-Family Homes and Condos | March 2018

Source: Honolulu Board of REALTORS®, compiled from MLS data

The median sales price of a condominium in March reached a new record high of $435,000, jumping ahead of the previous record of $430,000 set in January — and 8.8% ahead of the MSP in March 2017. Darryl Macha, president of the Honolulu Board of Realtors, points out that the March data may be skewed by resales of 20 luxury and multi-million-dollar units.

The median sales price of a single-family home on Oahu was up from $752,000 a year ago, to $760,000 last month. The record monthly high for a SF home was set in June 2017 — $795,000, the closest Oahu’s MSP has ever come to hitting $800,000.

It is interesting to note, the MSP have doubled since 2003 — roughly 15 years ago — when the MSP for a SF home was $380,000, and in 2004, the MSP for a condo was $208,000.

Median price is determined when half the homes sold for more and half sold for less.

HOT MARKETS!

Island wide, single-family home sellers are typically accepting offers for 97.4% of their original asking price, while condo owners are closer to 98.9%. We like to call out the hottest markets where, in these neighborhoods and due to bidding wars among buyers, the percentage of sales price to original price received by the seller is 100% or more, according to the current year-to-date stats.

Single-family homes selling in:

- Downtown—Nuuanu 101.2%

- Ewa Plain 100.3%

- Kalihi—Palama 101.6%

- Kaneohe 101.2%

- Kapahulu- Diamond Head 100.0%

- Makakilo 100.3%

- Pearl City—Aiea 100.1%

Condos selling in:

- Makakilo 100.0%

- Mililani 101.3%

- Pearl City — Aiea 100.5%

- Wahiawa 100.2%

- Waipahu 101.8%

Source: Honolulu Board of REALTORS®, compiled from MLS data. March 2018

Leave A Comment